Invest 93: A Comprehensive Guide

Invest 93, a term commonly used in the world of finance and investment, often sparks curiosity among beginners and seasoned investors alike. In this guide, we will delve into the intricacies of Invest 93, unpacking its meaning, significance, and how it influences investment decisions.

What is Invest 93?

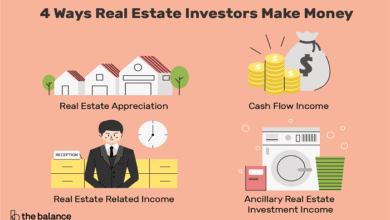

Invest 93, often referred to as an investment vehicle or opportunity, represents a specific project, venture, or initiative that holds potential for investment. It could encompass various forms such as startups, real estate developments, mutual funds, or even cryptocurrency projects. The term “Invest 93” is used to categorize and identify these opportunities within the investment landscape.

The Significance of Invest 93:

Invest 93 plays a significant role in diversifying investment portfolios and exploring new avenues for potential returns. It represents innovation, growth, and the pursuit of profitable ventures. For investors, identifying promising Invest 93 opportunities can lead to substantial financial gains and contribute to overall portfolio performance.

How Does Invest 93 Work?

Invest 93 operates through a combination of research, analysis, and investment capital. Investors typically conduct thorough due diligence to evaluate the viability and potential risks associated with a particular Invest 93 opportunity. Once deemed suitable, investors allocate capital towards the project, thereby fueling its development and growth.

Tracking Invest 93: Tools and Resources:

Various tools and resources are available to track and monitor Invest 93 opportunities. Online platforms, investment forums, and financial news outlets provide valuable insights and updates on emerging investment prospects. Additionally, investors can utilize data analytics and market research to assess the performance and trajectory of Invest 93 initiatives.

Risks Associated with Invest 93:

Like any investment, Invest 93 carries inherent risks that investors must consider. Market volatility, regulatory changes, and unforeseen circumstances can impact the success and profitability of Invest 93 ventures. It is essential for investors to conduct thorough risk assessments and implement risk management strategies to mitigate potential losses.

Strategies for Dealing with Invest 93:

To navigate the uncertainties associated with Invest 93, investors can employ various strategies such as diversification, hedging, and active portfolio management. By spreading investment capital across different asset classes and sectors, investors can minimize exposure to individual risks and enhance overall portfolio resilience.

Impact of Invest 93 on Market Sentiment:

The announcement or emergence of Invest 93 opportunities often influences market sentiment and investor confidence. Positive developments and successful outcomes can bolster optimism and drive market momentum, while setbacks or failures may lead to cautiousness and skepticism among investors.

Analyzing Historical Data of Invest 93:

Analyzing historical data and performance metrics of past Invest 93 initiatives can provide valuable insights into investment trends and patterns. By studying successful case studies and identifying common pitfalls, investors can make informed decisions and improve their investment strategies.

Investor Response to Invest 93:

The response of investors to Invest 93 opportunities varies based on individual risk tolerance, investment objectives, and market conditions. Some investors may embrace Invest 93 as a means of pursuing high-risk, high-reward investments, while others may approach it with caution and skepticism.

Long-Term Implications of Invest 93:

The long-term implications of Invest 93 extend beyond immediate financial returns. Successful Invest 93 ventures have the potential to drive economic growth, create employment opportunities, and foster innovation within industries. By supporting promising ventures, investors contribute to the broader ecosystem of entrepreneurship and development.

Conclusion

Invest 93 represents a dynamic and integral aspect of the investment landscape, offering opportunities for growth, innovation, and diversification. By understanding its significance, risks, and potential impact, investors can make informed decisions and navigate the complexities of the investment landscape with confidence.

FAQ:

1. What distinguishes Invest 93 from other investment opportunities?

Invest 93 typically refers to specific projects or ventures that are identified for investment purposes, distinguishing it from broader investment categories such as stocks, bonds, or commodities.

2. How can investors identify promising Invest 93 opportunities?

Investors can identify promising Invest 93 opportunities through thorough research, due diligence, and consultation with financial advisors or industry experts.

3. What role does risk management play in Invest 93 investments?

Risk management is essential in Invest 93 investments to mitigate potential losses and safeguard investment capital. Strategies such as diversification, hedging, and asset allocation help manage risks associated with Invest 93 ventures.

4. What factors should investors consider before investing in Invest 93 opportunities?

Before investing in Invest 93 opportunities, investors should consider factors such as market dynamics, regulatory environment, competitive landscape, and potential risks associated with the project or venture.

5. How can investors stay updated on Invest 93 developments?

Investors can stay updated on Invest 93 developments through various channels such as financial news outlets, investment forums, online platforms, and industry reports.

In summary, Invest 93 represents both opportunity and risk in the investment landscape, and understanding its intricacies is crucial for making informed investment decisions. By leveraging research, analysis, and risk management strategies, investors can maximize the potential of Invest 93 opportunities while safeguarding their financial interests.