Setting and Achieving Your Investment Goals: A Comprehensive Guide

Investing is an essential step toward achieving financial stability and growing your wealth. However, one of the most critical factors in making your investment strategy successful is setting clear investment goals. Whether you are saving for retirement, a child’s education, or simply aiming to build wealth, defining your investment goals provides direction and clarity in your investment journey. This comprehensive guide will explore the importance of setting investment goals, the different types of goals, how to set them, and how to create a plan to achieve them.

Why Are Investment Goals Important?

When you begin your investment journey, having a clear set of investment goals helps keep you on track. Without a clear purpose for your investments, it’s easy to get sidetracked by market volatility, emotional decisions, or distractions from other financial priorities. By setting specific, measurable, and achievable goals, you give your investments a sense of direction.

Having defined investment goals also helps to create a disciplined approach toward investing. Whether your goal is to save for a down payment on a house or build wealth for retirement, having a set objective will help you understand your risk tolerance, time horizon, and investment strategy. Setting goals not only helps you focus on long-term financial success but also provides motivation during market fluctuations.

Types of Investment Goals

There are various types of investment goals you can set, depending on your financial situation and future objectives. The most common investment goals include:

- Retirement Savings: Saving for retirement is one of the most common investment goals. A well-structured retirement plan helps you prepare for a financially secure future. Setting a specific retirement savings goal will guide you on how much to invest and when to begin.

- Education Funding: Many individuals invest to fund their children’s education. Setting an investment goal for education funding allows you to plan for future tuition costs and potentially reduce the financial burden of education expenses.

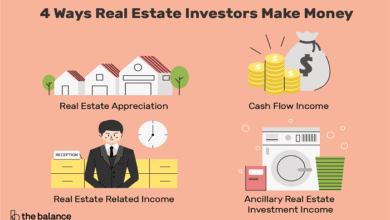

- Real Estate Investments: Whether you are looking to buy your first home or expand your real estate portfolio, this investment goal focuses on acquiring property.

- Wealth Accumulation: Some individuals invest simply to grow their wealth. This type of investment goal involves focusing on increasing your net worth over time through a diverse range of assets, such as stocks, bonds, and mutual funds.

- Emergency Fund: Establishing an emergency fund is another practical investment goal. While it may not involve high-risk investments, this goal aims to ensure you have cash reserves for unforeseen expenses.

Each of these goals requires different strategies, timelines, and levels of risk tolerance, which is why it’s essential to define and understand your own investment goals.

How to Set Realistic Investment Goals

Setting realistic investment goals is crucial for achieving financial success. While it’s tempting to set lofty goals, it’s important to keep them attainable based on your financial situation and risk profile. Here’s how to set practical investment goals:

- Assess Your Current Financial Situation: Before setting goals, evaluate your current income, savings, and debt levels. Understand how much you can allocate toward your investments and what your financial needs are in the short and long term.

- Define Your Time Horizon: Every investment goal has a different time frame. If you are saving for retirement in 30 years, you can afford to take more risks. On the other hand, if you are saving for a down payment on a home in the next 5 years, you may prefer safer investments.

- Set Specific, Measurable Goals: Instead of vague goals like “I want to save for retirement,” set specific goals such as, “I want to save $1 million for retirement by age 65.” This helps you track your progress and motivates you to stay on course.

- Understand Your Risk Tolerance: Every investment carries some level of risk. Assess your comfort level with risk and match it with the appropriate investment strategy. Some goals may require higher-risk investments, while others may call for a more conservative approach.

- Break Down Your Goals into Smaller Steps: Large goals can feel overwhelming. Break your investment goals down into smaller, more manageable milestones. For example, if your goal is to save $100,000 for retirement, set a goal to save $10,000 each year.

By following these steps, you’ll be on the right path toward setting investment goals that are both achievable and aligned with your financial situation.

Strategies for Achieving Your Investment Goals

Once you’ve set your investment goals, it’s time to develop strategies to achieve them. Here are some effective investment strategies to help you reach your objectives:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly, regardless of market conditions. It reduces the impact of market volatility and can help you stay disciplined in your investment approach. Dollar-cost averaging is ideal for long-term investment goals.

- Asset Allocation: Diversifying your investments is crucial to reducing risk and optimizing returns. Asset allocation involves spreading your investments across different asset classes, such as stocks, bonds, and real estate, based on your investment goals and risk tolerance.

- Reinvesting Dividends: If your investments generate dividends, reinvest them to purchase more shares. Reinvesting dividends can significantly boost the growth of your investments, especially for long-term investment goals like retirement.

- Tax-Efficient Investing: Taxes can erode your returns. Consider tax-efficient strategies such as investing in tax-advantaged accounts like IRAs or 401(k)s to minimize your tax burden while working toward your investment goals.

- Regularly Review and Adjust: Your financial situation and market conditions can change, so it’s important to periodically review your investments and make adjustments as needed. This ensures that your investment strategy is still in line with your goals.

By implementing these strategies, you can take actionable steps toward meeting your investment goals and build a successful investment portfolio over time.

How to Stay Motivated and Focused on Your Investment Goals

Staying motivated and focused on your investment goals can be challenging, especially during market downturns or times of uncertainty. Here are a few tips to keep you on track:

- Track Your Progress: Regularly monitor your progress toward achieving your investment goals. Whether through an online dashboard or financial planner, seeing how much closer you are to your goal will keep you motivated.

- Visualize Your Goals: Visualizing your goals can make them feel more tangible. Create a vision board or write down your goals and keep them somewhere visible to remind yourself of your financial objectives.

- Automate Your Investments: Automating your investments ensures that you consistently work toward your goals without having to think about it. Set up automatic transfers to your investment accounts, so you don’t miss a month of saving.

- Educate Yourself: The more you understand about investing, the more confident you’ll feel. Stay informed by reading books, articles, and blogs about investing. This will also help you make better decisions when working toward your investment goals.

- Celebrate Milestones: When you hit a milestone in your investment goals, such as saving a certain amount of money or reaching a certain percentage of your target, take a moment to celebrate. This helps keep you motivated for the long haul.

By employing these strategies, you can stay motivated, focused, and committed to achieving your investment goals.

Common Mistakes to Avoid While Setting Investment Goals

While setting and working toward your investment goals, it’s important to avoid common mistakes that could hinder your progress:

- Underestimating Risk: Some investors underestimate the risks involved in achieving their investment goals. It’s essential to have a clear understanding of your risk tolerance and avoid making decisions based on emotions or fear.

- Not Diversifying: Focusing on one type of investment, such as stocks, can increase the risk of your portfolio. Failing to diversify can lead to larger losses if that asset class performs poorly. Always diversify to reduce risk.

- Setting Unrealistic Goals: Setting overly ambitious investment goals can lead to disappointment and frustration. Ensure your goals are realistic based on your current financial situation and time horizon.

- Ignoring Inflation: Inflation can erode the purchasing power of your money over time. When setting long-term investment goals, factor in the impact of inflation to ensure your goals remain achievable.

- Not Having an Exit Strategy: Always have an exit strategy in place. If a particular investment isn’t working out, know when to cut your losses and move on to other opportunities.

By avoiding these mistakes, you can make more informed decisions and work effectively toward your investment goals.

Conclusion

Setting clear investment goals is the cornerstone of successful investing. Whether your goal is to save for retirement, fund education, or accumulate wealth, having a clear objective helps guide your investment decisions and strategies. By following the steps outlined in this guide, you can define your goals, create a plan, and stay motivated to achieve them. Remember, investing is a long-term journey that requires patience, discipline, and a focus on your goals. Stay committed to your investment goals, and over time, you’ll build the wealth and financial security you desire.

FAQs

- What are investment goals? Investment goals are specific financial objectives that you aim to achieve through investing, such as saving for retirement, buying a home, or building wealth.

- How do I set realistic investment goals? To set realistic goals, assess your current financial situation, define your time horizon, understand your risk tolerance, and set specific, measurable goals.

- Why are investment goals important? Investment goals provide direction and purpose, helping investors stay focused and disciplined. Clear goals lead to more effective investment strategies.

- What are some common types of investment goals? Common types of investment goals include saving for retirement, education funding, real estate investments, and wealth accumulation.

- How can I stay motivated to achieve my investment goals? Track your progress, visualize your goals, automate your investments, educate yourself, and celebrate milestones to stay motivated throughout your investment journey.