Market Fluctuations: A Comprehensive Guide

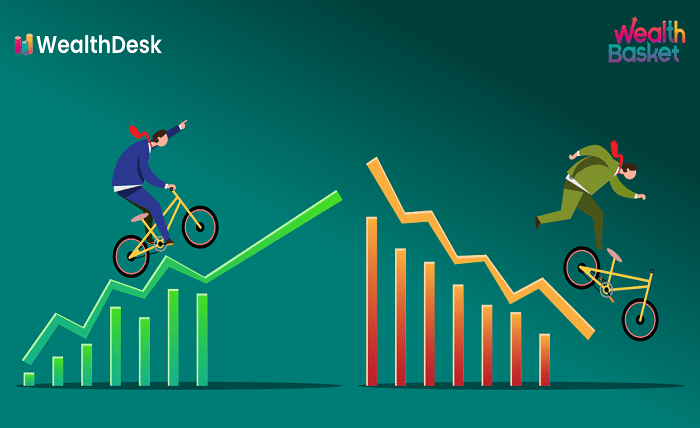

Market fluctuations refer to the variations or changes in the market—specifically in the prices of assets such as stocks, commodities, or currencies—over a certain period. These fluctuations occur due to numerous factors, including supply and demand dynamics, economic conditions, and investor sentiment. Understanding market fluctuations is crucial for investors and businesses to make informed decisions. Fluctuations can be small and short-term or significant and long-lasting, impacting various sectors of the economy differently.

Market fluctuations are a natural part of any economic system, and no market remains static for long. Recognizing the patterns and trends within these fluctuations is key to capitalizing on opportunities while minimizing risks.

Causes of Market Fluctuations

Understanding the causes of market fluctuations helps in anticipating potential changes and adjusting strategies accordingly. These are some of the primary drivers:

- Economic Indicators: Economic data, such as GDP growth rates, unemployment figures, and inflation reports, can significantly influence market fluctuations. Positive reports often drive markets upward, while negative ones lead to declines.

- Interest Rates: Central banks’ decisions on interest rates play a pivotal role. Higher rates generally decrease market liquidity, leading to downward fluctuations, while lower rates can stimulate growth.

- Geopolitical Events: Wars, trade disputes, and political instability create uncertainty, leading to increased market fluctuations as investors react to potential risks.

- Investor Sentiment: Human psychology heavily influences market behavior. Fear and greed often drive abrupt market fluctuations, even in the absence of tangible economic changes.

- Technological Advancements: Disruptive technologies or innovations can shake up industries, causing market fluctuations as companies adapt or fall behind.

The Impact of Market Fluctuations

Market fluctuations can have widespread effects, influencing not just investors but the broader economy. These impacts include:

- On Investments: For individual and institutional investors, market fluctuations determine portfolio values. While upward fluctuations increase wealth, downward trends can erode investments.

- On Businesses: Fluctuating markets affect corporate earnings and valuations. Companies reliant on stock market performance often experience volatility in their financial planning.

- On Consumer Behavior: When markets decline, consumers tend to spend less, fearing economic instability. Conversely, rising markets boost consumer confidence.

- On Employment: Economic downturns, often accompanied by significant market fluctuations, can lead to job losses and reduced hiring.

While the effects of market fluctuations can be daunting, understanding their broader implications allows stakeholders to adapt and thrive amid changing conditions.

Types of Market Fluctuations

Not all market fluctuations are created equal. Identifying the type of fluctuation can help in tailoring responses:

- Short-Term Fluctuations: These are often driven by day-to-day news, earnings reports, or minor economic shifts. Day traders and active investors frequently capitalize on these movements.

- Medium-Term Fluctuations: These typically span weeks or months and are influenced by quarterly earnings, sectoral changes, or moderate economic developments.

- Long-Term Fluctuations: Spanning years, these are linked to macroeconomic cycles, technological revolutions, or geopolitical shifts.

- Cyclical Fluctuations: Certain industries, like real estate or automotive, experience regular cycles of growth and decline, causing predictable market fluctuations.

- Structural Fluctuations: These result from significant economic or societal shifts, such as transitioning to renewable energy or widespread digital transformation.

How to Manage Market Fluctuations as an Investor

Successfully navigating market fluctuations requires a well-thought-out approach. Here are some strategies:

- Diversification: Spread investments across various asset classes, industries, and geographies to mitigate risk.

- Long-Term Focus: Avoid overreacting to short-term market fluctuations by maintaining a long-term investment horizon.

- Risk Assessment: Regularly evaluate your portfolio’s risk tolerance and adjust allocations to align with changing market conditions.

- Stay Informed: Monitor economic indicators, market news, and expert analysis to anticipate potential fluctuations.

- Use Hedging Strategies: Instruments like options or futures contracts can provide protection against adverse market fluctuations.

Adapting to market fluctuations requires patience, discipline, and a proactive mindset.

The Role of Technology in Market Fluctuations

Technology has revolutionized how markets operate and respond to fluctuations. Key developments include:

- Algorithmic Trading: Automated systems execute trades within milliseconds, magnifying market fluctuations in some cases.

- Data Analytics: Advanced analytics provide real-time insights into market trends, helping investors respond to fluctuations more effectively.

- Blockchain: Technologies like blockchain enhance transparency in trading and reduce inefficiencies, impacting market stability.

- Online Platforms: The accessibility of investment platforms has democratized trading, allowing more participants, which contributes to increased market fluctuations.

While technology amplifies certain aspects of market fluctuations, it also equips investors with tools to navigate them.

Strategies for Businesses to Adapt to Market Fluctuations

Businesses are not immune to market fluctuations, and adapting to them is essential for long-term sustainability. Strategies include:

- Flexible Planning: Dynamic financial planning allows businesses to adjust quickly to changing market conditions.

- Cost Management: During downturns, cutting unnecessary expenses ensures stability, while during booms, strategic investments can fuel growth.

- Market Diversification: Expanding into new markets reduces reliance on a single source of revenue, mitigating risks from market fluctuations.

- Investing in Innovation: Staying ahead of industry trends helps businesses thrive, regardless of fluctuations.

- Building Resilience: Establishing a strong financial reserve prepares businesses for unforeseen downturns.

Adopting these strategies ensures businesses remain competitive and adaptable during volatile periods.

Conclusion

Market fluctuations, while unpredictable, are a fundamental aspect of economic systems. They reflect the complex interplay of various factors, from economic data to human behavior. For investors and businesses, understanding and preparing for market fluctuations is not just beneficial—it’s essential. By staying informed, employing strategic approaches, and leveraging technological advancements, one can navigate market fluctuations effectively and turn challenges into opportunities.

FAQs

1. What causes market fluctuations?

Market fluctuations are caused by factors such as economic indicators, interest rates, geopolitical events, investor sentiment, and technological advancements.

2. Are market fluctuations always negative?

No, market fluctuations can be both positive and negative. They create opportunities for profit during upswings and learning during downturns.

3. How can I protect my investments during market fluctuations?

Diversification, long-term planning, staying informed, and using hedging strategies can help protect your investments during market fluctuations.

4. How do market fluctuations impact the economy?

Market fluctuations influence consumer spending, corporate earnings, employment rates, and overall economic stability.

5. Can market fluctuations be predicted?

While patterns and trends can provide clues, predicting market fluctuations with absolute accuracy is nearly impossible due to the complexity of influencing factors.