Different Asset Classes: A Comprehensive Guide

Introduction

In the realm of investing, understanding different asset classes is essential for creating a balanced portfolio. Asset classes are broad groups of investments that share similar characteristics and respond similarly to market conditions. They serve as the building blocks of any investment strategy, providing opportunities for diversification and risk management.

Each investor’s journey starts with learning about the different asset classes, which can include equities, fixed income, real estate, commodities, and alternative investments. By exploring these categories, you’ll gain insights into their unique attributes and how they contribute to achieving financial goals.

What Are Different Asset Classes?

Different asset classes are categories of financial instruments with similar financial structures and purposes. These classes include stocks, bonds, cash, and more specialized categories like commodities and real estate. The classification helps investors understand risk-return dynamics and choose investments suited to their objectives.

The major asset classes are typically divided based on factors such as risk, liquidity, and expected returns. Understanding these differences enables investors to allocate resources efficiently and create a diversified portfolio to mitigate risks and maximize returns.

Equities: A Key Component of Different Asset Classes

Equities, or stocks, are one of the most popular and widely recognized asset classes. They represent ownership in a company and offer the potential for significant capital growth. Investing in equities involves purchasing shares of publicly traded companies, making it an attractive option for investors seeking long-term returns.

Within the broader category of different asset classes, equities are known for their volatility and higher risk. However, they also provide the potential for substantial rewards. The performance of equities is influenced by factors such as economic conditions, company performance, and market trends.

Fixed Income Securities: Stability in Different Asset Classes

Fixed income securities, including bonds, are another important asset class. They provide investors with regular interest payments and return the principal amount upon maturity. Bonds are considered less risky compared to equities, making them a suitable choice for risk-averse investors.

This asset class includes government bonds, corporate bonds, and municipal bonds, each offering varying levels of risk and return. Among the different asset classes, fixed income securities are often used to preserve capital and generate steady income.

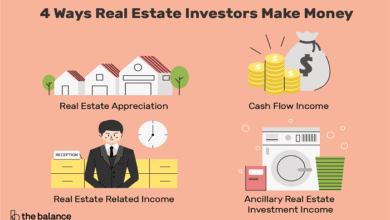

Real Estate: Tangible Value in Different Asset Classes

Real estate is a tangible asset class that involves investing in physical properties such as residential, commercial, or industrial spaces. It’s a popular choice for those looking to diversify their portfolio and protect against inflation.

Unlike other different asset classes, real estate investments can provide dual benefits of income generation through rents and capital appreciation over time. Real estate also tends to have a low correlation with other asset classes, making it a valuable addition to diversified portfolios.

Commodities: Physical Assets in Different Asset Classes

Commodities, such as gold, oil, and agricultural products, are another significant category among different asset classes. These are physical goods that can be bought and sold, often acting as a hedge against inflation and economic uncertainties.

Investors often include commodities in their portfolios to diversify and protect against market volatility. Among different asset classes, commodities are unique due to their dependency on global supply-demand dynamics and geopolitical factors.

Alternative Investments: Expanding the Horizon of Different Asset Classes

Alternative investments encompass a variety of assets that don’t fall into traditional categories like equities or bonds. These include hedge funds, private equity, venture capital, and cryptocurrencies. They offer higher returns but come with increased risk and limited liquidity.

Among the different asset classes, alternative investments provide opportunities for portfolio diversification and exposure to innovative sectors. However, they often require a higher level of expertise and due diligence due to their complexity.

Building a Diversified Portfolio with Different Asset Classes

A well-diversified portfolio includes a mix of different asset classes tailored to an investor’s risk tolerance, investment horizon, and financial goals. Diversification reduces the impact of poor performance in any single asset class and enhances overall portfolio stability.

Investors should regularly review their asset allocation to ensure alignment with market conditions and personal objectives. By leveraging the strengths of different asset classes, investors can create a robust portfolio that balances risk and reward effectively.

Conclusion

Different asset classes is a cornerstone of successful investing. Each asset class offers unique benefits and risks, contributing to a well-rounded investment strategy. Whether it’s the growth potential of equities, the stability of fixed income securities, or the diversification benefits of real estate and commodities, every asset class plays a vital role in achieving financial objectives.

By educating yourself on the nuances of different asset classes and maintaining a balanced portfolio, you can navigate the complexities of the financial markets with confidence and achieve long-term success.

FAQs

1. What are the main types of different asset classes?

The main types of different asset classes include equities, fixed income securities, real estate, commodities, and alternative investments.

2. Why is diversification important in different asset classes?

Diversification helps reduce risk by spreading investments across various asset classes, minimizing the impact of poor performance in any one category.

3. How do different asset classes respond to market conditions?

Different asset classes respond uniquely to market conditions, with equities being more volatile and fixed income securities providing stability.

4. What role does risk tolerance play in choosing different asset classes?

Risk tolerance determines the allocation of different asset classes in a portfolio, balancing higher-risk equities with lower-risk bonds or cash equivalents.

5. Can real estate and commodities act as hedges in different asset classes?

Yes, real estate and commodities often serve as hedges against inflation and economic uncertainties, providing stability to a diversified portfolio.