How to Invest in Gold: A Comprehensive Guide for Beginners

Introduction

Gold has long been a symbol of wealth and a reliable investment choice during times of economic uncertainty. Learning how to invest in gold can provide you with a hedge against inflation, diversify your portfolio, and add stability to your financial plan. Whether you are a beginner or an experienced investor, understanding the nuances of gold investments can help you make informed decisions.

This guide will walk you through various methods of gold investment, their advantages, and essential tips for getting started. By the end, you’ll have a clear understanding of how to invest in gold effectively.

Why Invest in Gold?

When considering how to invest in gold, it’s important to understand its unique benefits. Gold has historically maintained its value, serving as a safeguard during market downturns. Unlike stocks or bonds, gold is a tangible asset that doesn’t rely on the performance of a specific company or government.

Additionally, gold is often seen as a safe-haven asset during economic crises. It tends to perform well when other investments falter, making it an excellent option for those seeking stability. By understanding why people choose to invest in gold, you’ll be better equipped to decide how it fits into your financial strategy.

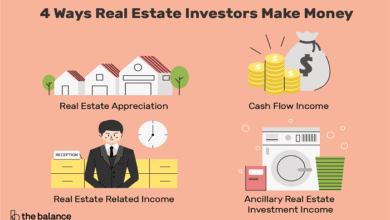

Types of Gold Investments

Understanding how to invest in gold involves exploring various forms of investment. Here are some popular options:

- Physical Gold: Buying gold bars, coins, or jewelry allows you to own the asset outright.

- Gold ETFs and Mutual Funds: These funds track the price of gold and provide a convenient way to invest without physical storage.

- Gold Mining Stocks: Investing in companies that extract gold offers potential for higher returns but comes with increased risk.

- Gold Futures and Options: These financial instruments allow experienced investors to speculate on gold’s future price movements.

- Digital Gold: Platforms now offer fractional ownership of gold stored in secure vaults, making it accessible to small investors.

By evaluating these options, you can choose the best method for how to invest in gold based on your goals and risk tolerance.

Steps to Start Investing in Gold

Learning how to invest in gold starts with a few essential steps:

- Set Clear Goals: Determine why you want to invest in gold, whether it’s for wealth preservation, portfolio diversification, or speculative gains.

- Research the Market: Understand the factors influencing gold prices, including inflation, currency values, and geopolitical events.

- Choose Your Investment Method: Decide between physical gold, ETFs, mining stocks, or other options based on your preferences and resources.

- Find Reliable Platforms: Ensure you buy from reputable dealers, exchanges, or brokers to avoid fraud and ensure quality.

- Monitor Your Investment: Keep track of gold market trends and adjust your strategy as needed.

By following these steps, you’ll develop a solid foundation on how to invest in gold successfully.

Pros and Cons of Gold Investments

Understanding the advantages and disadvantages of gold is crucial when learning how to invest in gold.

Pros:

- Inflation Hedge: Gold often retains value during inflationary periods.

- Portfolio Diversification: It reduces overall risk by balancing your investment portfolio.

- Liquidity: Gold is highly liquid, making it easy to buy or sell globally.

- Tangible Asset: Physical gold provides a sense of security.

Cons:

- Storage Costs: Physical gold requires secure storage, adding to expenses.

- Volatility: Gold prices can fluctuate based on market conditions.

- No Yield: Unlike stocks or bonds, gold doesn’t generate dividends or interest.

- High Premiums: Buying physical gold often involves premium costs over the spot price.

Considering these factors will help you decide the best approach for how to invest in gold.

Tips for Successful Gold Investment

To master how to invest in gold, consider the following expert tips:

- Diversify Your Holdings: Avoid putting all your resources into gold; balance it with other investments.

- Start Small: Begin with a modest investment and increase as you gain confidence.

- Nderstand Timing: Monitor market conditions to buy during price dips.

- Avoid Emotional Decisions: Stick to your investment strategy and avoid impulsive purchases.

- Stay Informed: Keep updated with gold market news and economic indicators.

By applying these tips, you’ll enhance your ability to invest in gold wisely.

Risks Associated with Gold Investments

Like any investment, learning how to invest in gold involves understanding the risks:

- Market Volatility: Gold prices can rise or fall due to geopolitical or economic events.

- Counterparty Risks: Buying gold ETFs or digital gold involves trusting third-party entities.

- Storage Challenges: Physical gold requires secure storage, which can be costly.

- Illiquidity of Rare Forms: Certain gold coins or jewelry may be harder to sell at market value.

Awareness of these risks will enable you to make informed decisions on how to invest in gold.

Conclusion

Investing in gold is a time-tested strategy for wealth preservation and portfolio diversification. By learning how to invest in gold through various methods like physical gold, ETFs, mining stocks, and digital platforms, you can tailor your investment approach to your goals and risk appetite. Remember to research thoroughly, set clear objectives, and monitor market trends to make the most of your gold investments.

Whether you’re safeguarding against inflation or seeking stability, gold remains a valuable asset worth considering. Start small, stay informed, and enjoy the journey of securing your financial future with gold.

FAQs

1. What is the best way to invest in gold for beginners?

The best way for beginners to invest in gold is through gold ETFs or mutual funds, as they offer a low-cost, hassle-free approach without the need for physical storage.

2. Is investing in physical gold better than digital gold?

Both options have pros and cons. Physical gold provides tangible ownership, while digital gold is convenient and eliminates storage concerns. Choose based on your preferences.

3. How does gold act as a hedge against inflation?

Gold retains its value when fiat currencies lose purchasing power, making it an effective hedge against inflation over time.

4. What factors influence gold prices?

Gold prices are influenced by inflation, currency fluctuations, interest rates, geopolitical events, and central bank policies.

5. Can I lose money investing in gold?

Yes, gold investments carry risks like price volatility, counterparty risks, and storage costs. Proper research and strategy can minimize these risks.