How to Invest in Real Estate: A Comprehensive Guide

Investment

Real estate investment has long been a cornerstone of wealth creation. If you’ve ever wondered how to invest in real estate, you’re not alone. This asset class offers opportunities for diversification, passive income, and long-term financial growth. Understanding the basics is essential before diving into this dynamic market.

Investing in real estate can take many forms, from purchasing a single-family home to developing commercial properties. The key is to start by educating yourself about the market, understanding different investment strategies, and evaluating your financial capacity.

The Benefits of Investing in Real Estate

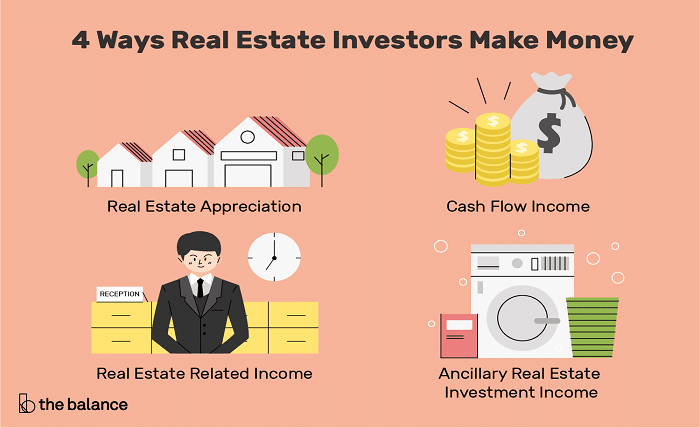

Exploring how to invest in real estate reveals numerous advantages that set this asset class apart from others. Real estate often appreciates in value over time, providing an opportunity for significant returns. Moreover, rental properties generate steady passive income, helping you build wealth.

Another major benefit is the ability to leverage financing. By using borrowed capital, you can purchase properties worth more than your initial investment, amplifying potential returns. Tax advantages, including deductions for mortgage interest and property depreciation, further enhance the appeal of real estate.

Types of Real Estate Investments

To master how to invest in real estate, it’s crucial to understand the various types of investments available. Each category has unique characteristics and risk levels.

- Residential Properties: These include single-family homes, condominiums, and multi-family units. Residential properties are ideal for beginners due to their broad market appeal.

- Commercial Properties: These consist of office buildings, retail spaces, and industrial facilities. They often provide higher returns but require more significant investment.

- Real Estate Investment Trusts (REITs): If you’re wondering how to invest in real estate without owning physical property, REITs allow you to invest in real estate portfolios through publicly traded shares.

- Vacation Rentals: Platforms like Airbnb have made it easier to profit from short-term rentals, offering high-income potential in desirable locations.

- Land Investments: Buying undeveloped land can be lucrative if the property appreciates or is developed.

How to Get Started in Real Estate Investing

Starting your journey in real estate begins with preparation. To effectively learn how to invest in real estate, follow these key steps:

- Set Clear Goals: Define what you hope to achieve with real estate investment. Are you looking for passive income, long-term growth, or portfolio diversification?

- Assess Your Finances: Determine your budget and financing options. Understanding your credit score and savings will help secure favorable loans.

- Research the Market: Analyze market trends, property values, and rental demands in your chosen area.

- Choose an Investment Strategy: Decide whether you want to focus on residential rentals, flipping properties, or REITs.

- Build a Network: Connect with real estate agents, contractors, and other investors who can guide you.

Financing Your Real Estate Investment

Securing financing is a pivotal step when learning how to invest in real estate. Most investors rely on mortgages, but other options are available.

- Conventional Loans: Offered by banks and credit unions, these are ideal for those with strong credit and steady income.

- FHA Loans: Designed for first-time buyers, these loans have lower down payment requirements.

- Private Lending: Some investors opt for private loans from individuals or companies.

- Hard Money Loans: These short-term loans are great for house flippers who need quick cash.

- Partnerships: Teaming up with other investors allows you to pool resources and share risks.

Managing Risks in Real Estate Investment

Understanding risk management is essential for anyone learning how to invest in real estate. Real estate markets can be volatile, and unforeseen issues like tenant disputes or property damage can arise. To mitigate risks, diversify your investments across different property types and locations.

Investing in insurance policies for your properties is crucial. Additionally, maintaining an emergency fund can help cover unexpected expenses. Working with experienced professionals, such as real estate attorneys and property managers, ensures your investments are protected.

Building Long-Term Wealth Through Real Estate

One of the most compelling reasons to learn how to invest in real estate is its potential to build long-term wealth. By reinvesting profits, expanding your portfolio, and leveraging appreciation, you can create a sustainable income stream.

Focus on properties with strong cash flow and appreciation potential. Over time, you’ll benefit from compounded returns and increased equity. Remember to stay informed about market trends and adapt your strategies as needed.

Conclusion

Learning how to invest in real estate is a rewarding journey that requires careful planning and execution. By understanding the market, choosing the right investment strategies, and managing risks effectively, you can achieve financial independence and long-term success. Start small, stay informed, and watch your investments grow over time.

FAQs

1. What is the best way to start investing in real estate?

The best way to start is by educating yourself, setting clear goals, and analyzing your finances. Begin with smaller investments like residential properties or REITs to gain experience.

2. Can I invest in real estate with little money?

Yes, you can. Options like REITs, partnerships, or house hacking allow you to invest with minimal upfront capital.

3. Is real estate a good investment for beginners?

Real estate is excellent for beginners due to its tangible nature, potential for passive income, and long-term appreciation. Start small and grow your portfolio over time.

4. How do I choose the right location for investment?

Look for areas with strong job growth, population increases, and low crime rates. Research market trends and rental demand in the region.

5. What are the risks of real estate investing?

Risks include market volatility, property damage, tenant disputes, and unexpected expenses. Diversification and proper planning can help mitigate these risks.