GNPX Stock: A Comprehensive Analysis

Introduction

In the dynamic landscape of the stock market, one name that has been garnering attention is GNPX stock. GNPX, short for Genprex Inc., represents a promising investment opportunity in the biotechnology sector. In this comprehensive analysis, we will explore the various facets of GNPX stock, from its inception to its current position, shedding light on its potential for investors.

GNPX: A Brief Overview

Genprex Inc. (GNPX) is a clinical-stage gene therapy company focused on developing innovative solutions for the treatment of cancer. Founded in [year], the company has emerged as a frontrunner in the biotechnology sector, with its groundbreaking research and development efforts aimed at addressing unmet medical needs in oncology.

The Rise of GNPX: A Historical Perspective

The journey of GNPX stock has been marked by significant milestones, reflecting the company’s relentless pursuit of innovation and growth. Since its inception, GNPX has witnessed steady progress in its clinical programs, bolstering investor confidence and driving the stock’s upward trajectory.

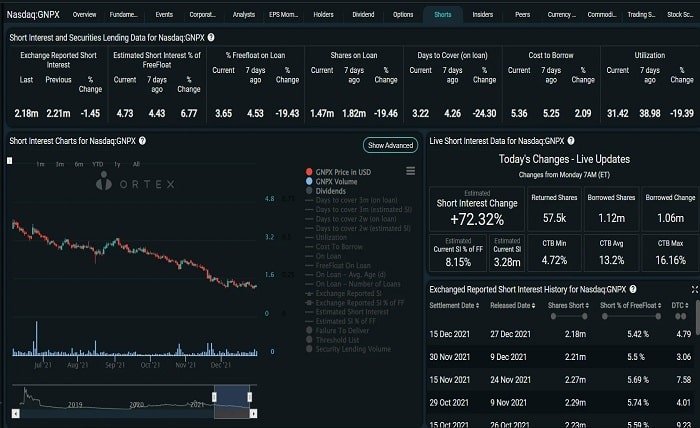

Exploring GNPX’s Market Performance

In the ever-evolving stock market landscape, GNPX has emerged as a standout performer, attracting investors with its promising growth prospects and innovative approach to cancer treatment. With a focus on leveraging cutting-edge gene therapy technologies, GNPX aims to revolutionize cancer treatment paradigms, potentially transforming the lives of patients worldwide.

GNPX’s Innovative Pipeline: A Closer Look

At the heart of GNPX’s success lies its robust pipeline of innovative gene therapy solutions. With a diverse portfolio of candidates targeting various cancer types, GNPX is well-positioned to capitalize on the growing demand for personalized medicine and targeted therapies, offering new hope to patients battling cancer.

Analyzing GNPX’s Financial Health

A crucial aspect of any investment decision is assessing the financial health of the company in question. In the case of GNPX, investors can take solace in the company’s sound financial footing, supported by prudent management practices and a strong focus on operational efficiency.

GNPX’s Competitive Landscape: Opportunities and Challenges

While GNPX occupies a unique position in the biotechnology landscape, it is not immune to competition and market dynamics. As the company continues to advance its pipeline and expand its market presence, it must navigate various challenges, including regulatory hurdles and competitive pressures, to sustain its growth momentum.

Investor Sentiment and Analyst Projections

The sentiment surrounding GNPX stock remains largely positive, with investors and analysts alike expressing optimism about the company’s growth prospects. Analyst projections suggest a bullish outlook for GNPX, citing its robust pipeline and strategic partnerships as key drivers of future growth.

Risks and Considerations for GNPX Investors

While GNPX presents an attractive investment opportunity, it is essential for investors to be mindful of the inherent risks and uncertainties associated with investing in biotechnology stocks. Factors such as clinical trial outcomes, regulatory approvals, and market volatility can significantly impact the performance of GNPX stock in the short and long term.

Future Outlook: What Lies Ahead for GNPX?

Looking ahead, GNPX is poised for continued growth and innovation, driven by its relentless pursuit of groundbreaking gene therapy solutions for cancer treatment. With a strong foundation in place and a clear vision for the future, GNPX is well-equipped to capitalize on emerging opportunities in the biotechnology sector, creating value for investors and patients alike.

Conclusion

GNPX stock represents a compelling investment opportunity in the burgeoning field of biotechnology. With its innovative pipeline, strong financial position, and bullish market sentiment, GNPX is poised to deliver significant value for investors in the years to come. By understanding the dynamics of GNPX stock and staying abreast of developments in the biotechnology sector, investors can position themselves to seize the potential growth opportunities presented by this promising asset.

FAQs (Frequently Asked Questions)

1. What is GNPX stock, and what does the company do?

GNPX stock represents shares in Genprex Inc., a clinical-stage gene therapy company focused on developing innovative solutions for cancer treatment. The company’s research and development efforts center around leveraging cutting-edge gene therapy technologies to address unmet medical needs in oncology.

2. What factors contribute to the growth potential of GNPX stock?

Several factors contribute to the growth potential of GNPX stock, including the company’s robust pipeline of gene therapy candidates, strategic partnerships, and positive investor sentiment. Additionally, advancements in the field of oncology and increasing demand for personalized medicine further bolster GNPX’s growth prospects.

3. What are the risks associated with investing in GNPX stock?

Like any investment, GNPX stock carries inherent risks and uncertainties. Key risks for investors to consider include clinical trial outcomes, regulatory approvals, competitive pressures, and market volatility. It is essential for investors to conduct thorough due diligence and assess their risk tolerance before investing in GNPX or any biotechnology stock.

4. How can investors stay informed about developments related to GNPX stock?

Investors can stay informed about developments related to GNPX stock by monitoring the company’s press releases, regulatory filings, and investor presentations. Additionally, following reputable financial news sources and analyst reports can provide valuable insights into GNPX’s performance and future prospects.

5. What is the long-term outlook for GNPX stock?

While the long-term outlook for GNPX stock is subject to various factors, including clinical trial results and regulatory approvals, the company’s innovative approach to cancer treatment and strong pipeline position it for potential growth in the years to come. However, investors should remain vigilant and adapt their investment strategies based on evolving market conditions and company developments.